A lot of attention has been paid to the recent Newspoll which puts the Gillard Government at "Even Stephens" with the Coalition based on 2 Party Preferred vote...50% each. And while it is true that this poll is a bit of a fillip for Labor, the Goat wonders if this is really an accurate measure of the state of play regarding Gillards support.

One thing that should always be considered when looking at Polls is the threat of outliers. To combat that I will use a 4 poll average to try and smooth away any potential one off bumps in the polls. Using the last 4 News poll results, we find that the 2PP vote is actually 47.75 % to Labor and 52.25% to the Libs/Nationals. Not looking so good now for the Government.

But maybe that is just the News Poll. My favourite forecaster, J Scott Armstrong, recommends using a combination of predictions and then weighting them equally to gain the most accurate forecast. To do this, I have taken the last 4 poll averages for the two other fortnightly pollers (Essential and Roy Morgan). The 4 poll average from Essential puts the 2PP at 53.25/47.75 in favour of the Coalition, Roy Morgan puts it at 51/49 the same way.

Weighting the three polls equally (1/3 each), the 2PP is now looking at 52.2% to the Coalition, 47.8% to Labor.

Labor is definitely improving, but not quite even yet. Will keep you informed of any changes in the Gillard Goatameter as we get closer to election day.

Tuesday, October 30, 2012

Friday, October 26, 2012

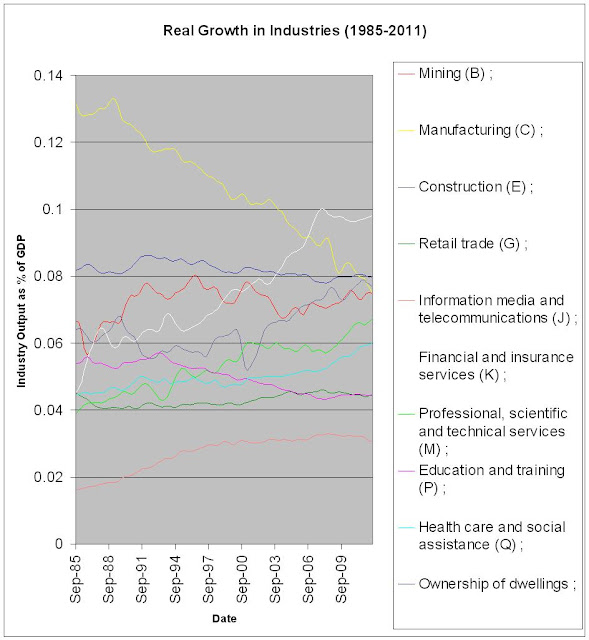

Real Growth in Australian Industries.

Take away's from this graph :-

1. The rise of construction, Financial Services and Professional, scientific and technical services.

2. The massive reduction in output from Manufacturing.

3. The flatness of two industries that are traditionally pointed to as sources of growth; Education and training and Ownership of dwellings

4. The flatness of the IT industry after the IT crash of 2001.

5. The mining boom may just be a recovery from a slump in 2003.

6. Health care and social assistance could be the major growth areas in future due to the aging population.

Wednesday, October 24, 2012

Is there a Housing Bubble in Sydney?

Might have been in 2007 and again in 2009, but not any more. According to the graph above, prices haven't really consistantly increased in the last 10 years. Every increase has been met with a correction. No wonder the RBA isn't that concerned. Be interesting to do the same for the other states.

Tuesday, October 23, 2012

Swannies 6 month $555 million interest free loan

Looking at the MYEFO released yesterday, most of the attention has been on the Baby Bonus reduction, and the Company Tax change to pay monthly instead of quarterly.

But for mine, the biggest (and dodgiest) change is the change to the inactive Superannuation account rules.

Basically the change is the Government authorizing the compulsory transfer of more small and inactive super accounts to the ATO by changing the definition of what a small, inactive account is. The change is from the previous rule of a balance of under $200 that hasn’t been touched in 5 years to a balance of under $2000 that hasn’t been touched in 1 year.

This is dodgy enough. But what really annoys me is the fact that while the Government has said it will pay interest at a rate of CPI, the interest only starts accruing in July 2013 (while the confiscation of the funds from the Super Accounts takes place in December 2012). So effectively, Swan is helping himself to an interest free loan, on the backs of people with inactive Super accounts of $2000 or less (likely to be the poor and financially illiterate). All for political ends.

And those poor people who get their Superannuation transferred? Well, they are going to be missing out on the interest they could have earned over that 6 month period.

Now some people will say, big deal. It's likely to be small amounts (likely to be 0.74% to 4% depending on the fund being retail or industrial). But this is still $20 to $50 being stolen from the retirement savings of those who will need every dollar they can save for retirement (and likely to be Labor voters)

Not quite Labor values in my opinion..

But for mine, the biggest (and dodgiest) change is the change to the inactive Superannuation account rules.

Basically the change is the Government authorizing the compulsory transfer of more small and inactive super accounts to the ATO by changing the definition of what a small, inactive account is. The change is from the previous rule of a balance of under $200 that hasn’t been touched in 5 years to a balance of under $2000 that hasn’t been touched in 1 year.

This is dodgy enough. But what really annoys me is the fact that while the Government has said it will pay interest at a rate of CPI, the interest only starts accruing in July 2013 (while the confiscation of the funds from the Super Accounts takes place in December 2012). So effectively, Swan is helping himself to an interest free loan, on the backs of people with inactive Super accounts of $2000 or less (likely to be the poor and financially illiterate). All for political ends.

And those poor people who get their Superannuation transferred? Well, they are going to be missing out on the interest they could have earned over that 6 month period.

Now some people will say, big deal. It's likely to be small amounts (likely to be 0.74% to 4% depending on the fund being retail or industrial). But this is still $20 to $50 being stolen from the retirement savings of those who will need every dollar they can save for retirement (and likely to be Labor voters)

Not quite Labor values in my opinion..

Subscribe to:

Posts (Atom)